You can now set up next month’s budget.For instance, maybe your typical $500 grocery bill jumps to $700 in November and December, or you pay your homeowners insurance premium at the beginning of each year. Estimate how much you’ll spend in different categories each month over the next year.Use last year’s pay stubs as a reference point and adjust as needed (perhaps you recently got a raise or finalized a new business deal). Estimate how much you’ll earn each month over the next year.Variable/discretionary ordinary living expenses (such as food, clothing, household expenses, medical payments, and other items for which your monthly spending tends to fluctuate).Fixed costs (such as housing payments, utility bills, charitable contributions, insurance premiums, and loan payments).Separate your spending categories into main buckets.(This is an especially useful exercise if you have uneven income.)

For instance, let’s say you spent $500 in January on groceries, which was 12% of your household earnings. Note how much you spent in each category every month, as well as what percentage of your monthly income that spending represented.

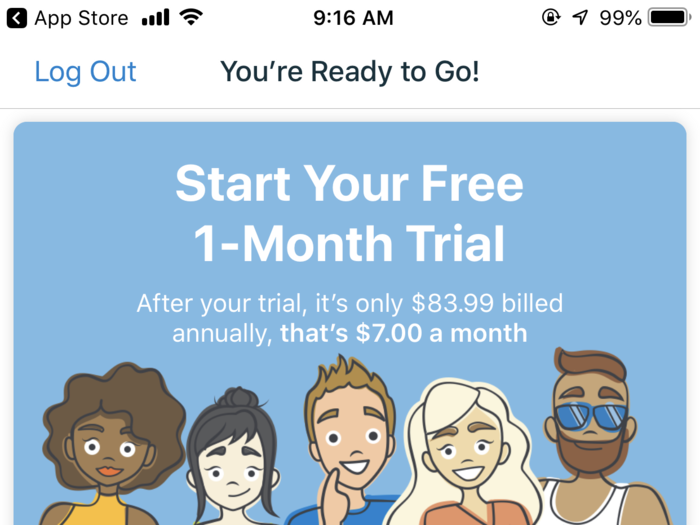

Tracking apps offer a 30,000-foot view of your finances, display your transactions in real time, and require very little effort to set up. There are two basic types of budget apps: trackers ( à la Mint) and zero-balancers.

0 kommentar(er)

0 kommentar(er)